Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Financial Planner OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Crafting effective OKRs can be challenging, particularly for beginners. Emphasizing outcomes rather than projects should be the core of your planning.

We've tailored a list of OKRs examples for Financial Planner to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Financial Planner OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

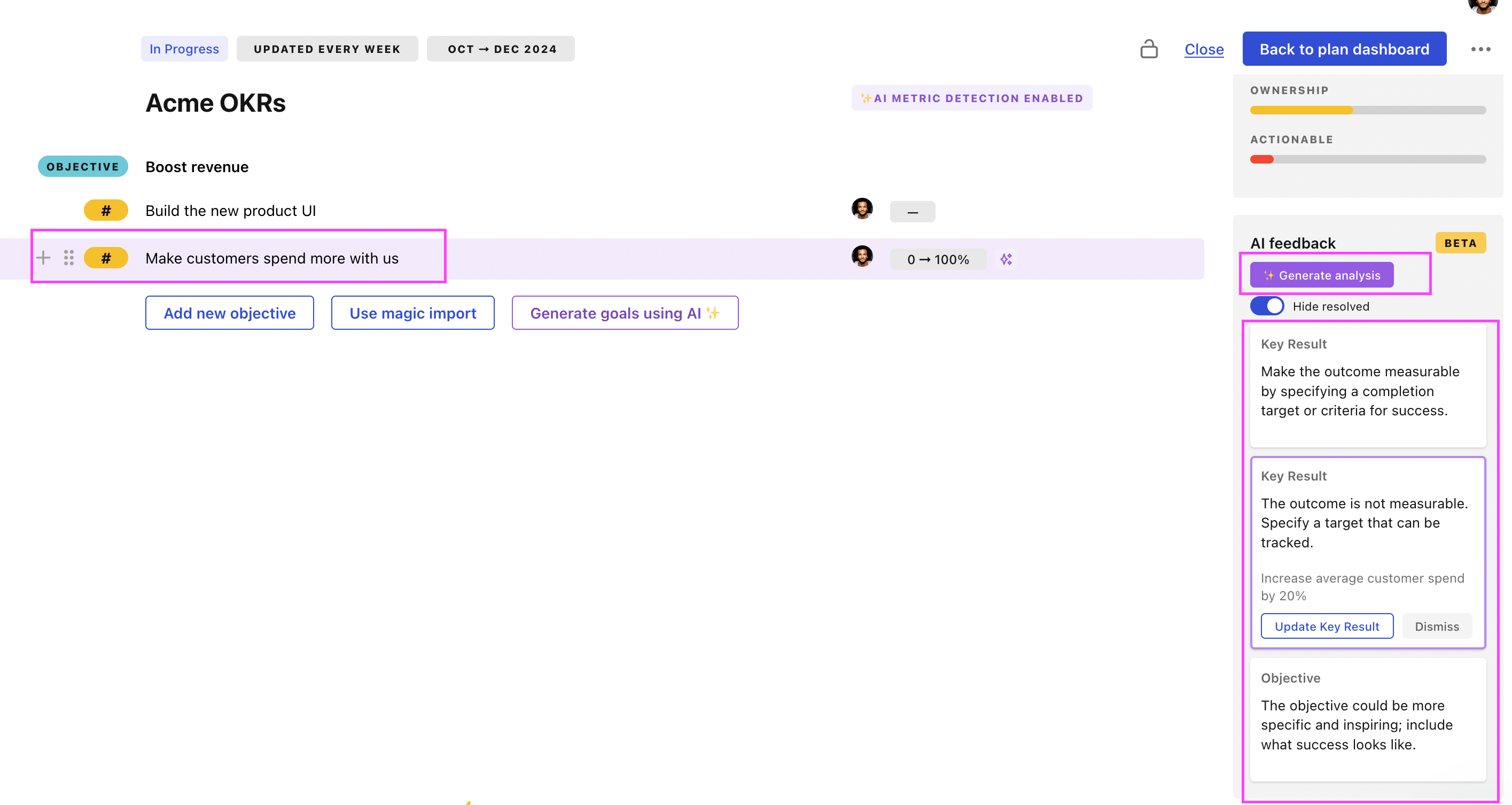

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Financial Planner OKRs examples

You will find in the next section many different Financial Planner Objectives and Key Results. We've included strategic initiatives in our templates to give you a better idea of the different between the key results (how we measure progress), and the initiatives (what we do to achieve the results).

Hope you'll find this helpful!

OKRs to improve financial planning and performance accountability for the company

ObjectiveImprove financial planning and performance accountability for the company

KRDevelop and implement a new budgeting system by the end of the quarter

Implement the new budgeting system across all departments

Research various existing budgeting systems for possible adoption

Develop a unique budgeting system based on research

KRReduce overhead costs by 15% through efficient resource management

Implement energy-saving measures in office and warehouse facilities

Streamline product sourcing for reduced material costs

Increase training focus on efficient resource use

KRIncrease financial forecasting accuracy by 20%

Conduct regular reviews and adjustments of forecasts

Integrate real-time data into forecasting model

Implement advanced financial forecasting software

OKRs to formulate a robust 7-year financial plan

ObjectiveFormulate a robust 7-year financial plan

KRFinalize full 7-year financial plan after conducting 3 rounds of reviews by Week 12

Make necessary revisions based on the review feedback

Finalize and approve the 7-year financial plan by Week 12

Conduct 3 rounds of reviews for the 7-year financial plan

KRIdentify and document all major revenue and expense sources by Week 6

Document all major revenue sources

Identify all major revenue sources by Week 6

Record all major expense sources by Week 6

KRCreate projection models and validate accuracy for the first 2 years by Week 9

Validate accuracy of models by Week 9

Develop projection models based on gathered data

Gather data relevant to creating projection models

OKRs to achieve personal and financial stability

ObjectiveAchieve personal and financial stability

KRSpend less than monthly income to create savings buffer of 15%

Cut back on unnecessary costs

Establish a strict monthly budget plan

Allocate 15% of every paycheck to savings

KRSecure steady income by landing a full time job

Update and optimize your resume to highlight relevant skills and experiences

Prep and practice for potential job interviews

Research and apply to job openings in your chosen field

KRAttend 1 personal development workshop per month to enhance emotional stability

Register and pay for selected workshops

Participate fully in each workshop

Research and find upcoming personal development workshops

OKRs to grow personal net worth to $1m through strategic investments and savings

ObjectiveGrow personal net worth to $1m through strategic investments and savings

KRInvest 30% of saved income wisely in high-yield platforms

Allocate 30% of saved income for investment

Strategically invest funds in chosen platforms

Identify high-yield investment platforms with a good reputation

KRLimit expenses to save 50% of each month's income

Establish a consistent habit of depositing savings first

Splurge on necessities only to cut down on extra expenses

Consider cost-effective versions of daily used items

KRIncrease passive income by 30% through evaluation and portfolio diversification

Research diverse investment opportunities for higher returns

Analyze current portfolio to identify underperforming assets

Allocate investments strategically to profitable assets

OKRs to establish solid groundwork for expansion into new markets

ObjectiveEstablish solid groundwork for expansion into new markets

KRDevelop tailored expansion strategy for each identified market

Review and refine strategies based on potential return analysis

Apply insights to craft unique growth strategies per market

Conduct comprehensive research on identified markets' characteristics

KRSecure financial resources necessary for the initial phase of expansion

Research potential funding sources and investors

Submit proposals or applications for funding

Identify necessary budget for expansion activities

KRIdentify and analyze potential markets for viability by the quarter-end

Conduct thorough research on emerging markets and trends

Analyze the demands and profitability of potential markets

Present a detailed report on market viability analysis

OKRs to enhance spendability for improved customer satisfaction

ObjectiveEnhance spendability for improved customer satisfaction

KRImplement 2 new customer-focused promotional campaigns

Execute and monitor the promotional campaigns

Identify potential customer needs and interests for promotional campaigns

Develop strategies and materials for two new campaigns

KRIncrease monthly budget allocation to customers by 20%

Implement the new increased budget into the financial plan

Determine a 20% increase of these individual amounts

Calculate the current budget allocation for each customer

KRImprove customer service training to decrease complaints by 30%

Implement comprehensive customer service training program

Address complaint areas during team coaching sessions

Monitor and assess staff's interaction with customers

OKRs to successfully save money to build an investment fund

ObjectiveSuccessfully save money to build an investment fund

KRSet aside 20% of monthly income to a dedicated savings account

Open a separate savings account for monthly deposits

Set up monthly automatic transfers to savings account

Calculate 20% of anticipated monthly income

KRResearch and select 2-3 potential investment opportunities

Conduct thorough research on potential investment opportunities

Define specific criteria for selecting investment opportunities

Choose 2-3 investments that meet your criteria

KRReduce unnecessary expenditure by 15% to increase savings

Identify and eliminate all nonessential expenses

Regularly review and adjust the budget plan

Utilize cash over credit to avoid overspending

OKRs to develop and implement a high-performing autonomous book trading system

ObjectiveDevelop and implement a high-performing autonomous book trading system

KRSecure new book trading deals worth a cumulative total of $1.25 million

Finalize and sign agreed book trading contracts

Negotiate trading deals aiming for $1.25 million

Identify and reach out to prospective book trading partners

KRDesign an algorithm capable of optimizing book trading transactions by 30%

Draft algorithm parameters to improve transactions by 30%

Test and refine the algorithm iteratively

Define desirable optimization metrics for book trading transactions

KRAchieve a consistent monthly revenue increase of 15% through automated trades

Continuously monitor and adjust trade algorithms' performance

Incorporate artificial intelligence into trading activities

Train algorithms for recognizing profitable trade patterns

OKRs to successfully launch a small business

ObjectiveSuccessfully launch a small business

KRSecure initial funding of at least $X through personal savings, loans, or investors

Determine available personal savings for business investment

Research loan options and apply where feasible

Begin networking to attract potential investors

KRDevelop a comprehensive business plan by identifying key opportunities and potential risks

Identify key opportunities in your business sector

Analyze potential risks to your business

Draft a comprehensive business plan

KRSecure a location and necessary permits to operate, ensuring regulatory compliance

Establish procedures to assure continuous regulatory compliance

Identify potential operating locations suiting the business requirements

Initiate application process for necessary operating permits

OKRs to grow personal net worth to $1M

ObjectiveGrow personal net worth to $1M

KRInvest 30% of income in high-yield, low-risk opportunities

Allocate funds towards selected investment opportunities

Determine the amount equalling 30% of your yearly income

Research high-yield, low-risk investment options

KRIncrease monthly income by 50% through diversifying income streams

Learn and engage in e-commerce or online business opportunities

Explore and invest in a variety of income generating assets

Start a side job or freelance work related to your skills

KRReduce monthly expenses by 20% through budgeting and disciplined spending

Establish a strict weekly budget and stick to it

Cut out unnecessary expenses such as dining out

Regularly review and adjust spending habits

Financial Planner OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

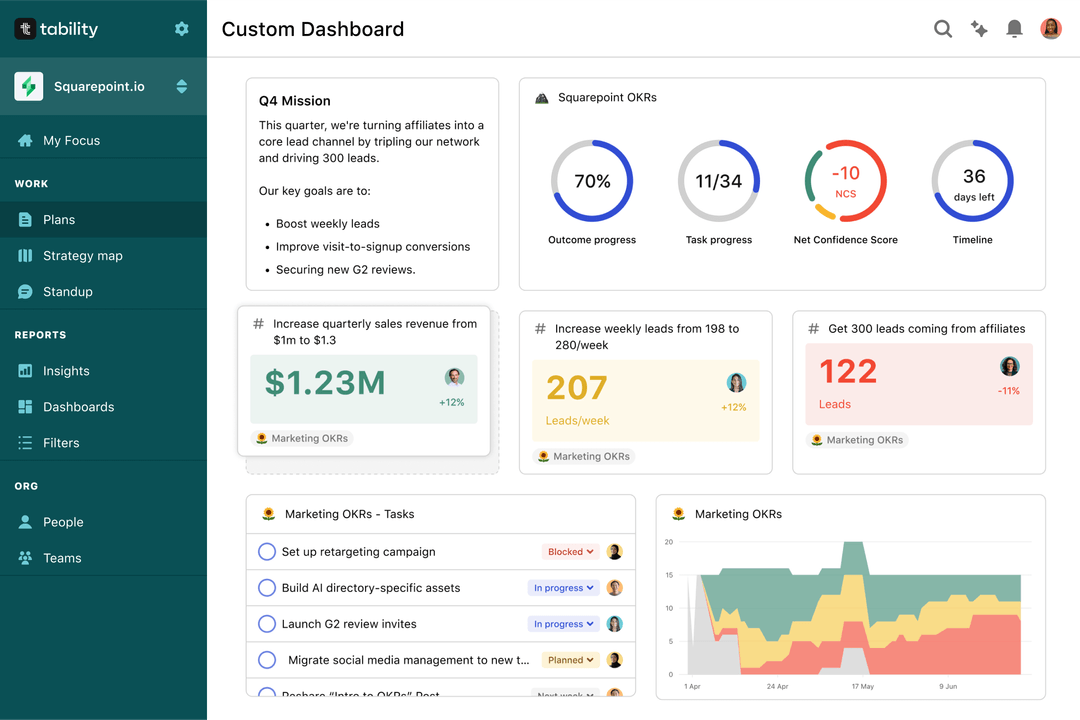

Save hours with automated Financial Planner OKR dashboards

OKRs without regular progress updates are just KPIs. You'll need to update progress on your OKRs every week to get the full benefits from the framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Financial Planner OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to cultivate a culture of growth and empowerment among our teams

OKRs to enhance the quality of our App notifications

OKRs to enhance leadership capabilities through diverse trainings and self-study

OKRs to certify in development using JTA, Blueprint, Item writing & peer reviews

OKRs to full deployment of Ember and Abnormal Security tools in SecOps

OKRs to enhance team's effectiveness in sales and customer service through specialized training