Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Regulatory Compliance Officer OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Formulating strong OKRs can be a complex endeavor, particularly for first-timers. Prioritizing outcomes over projects is crucial when developing your plans.

We've tailored a list of OKRs examples for Regulatory Compliance Officer to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Regulatory Compliance Officer OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

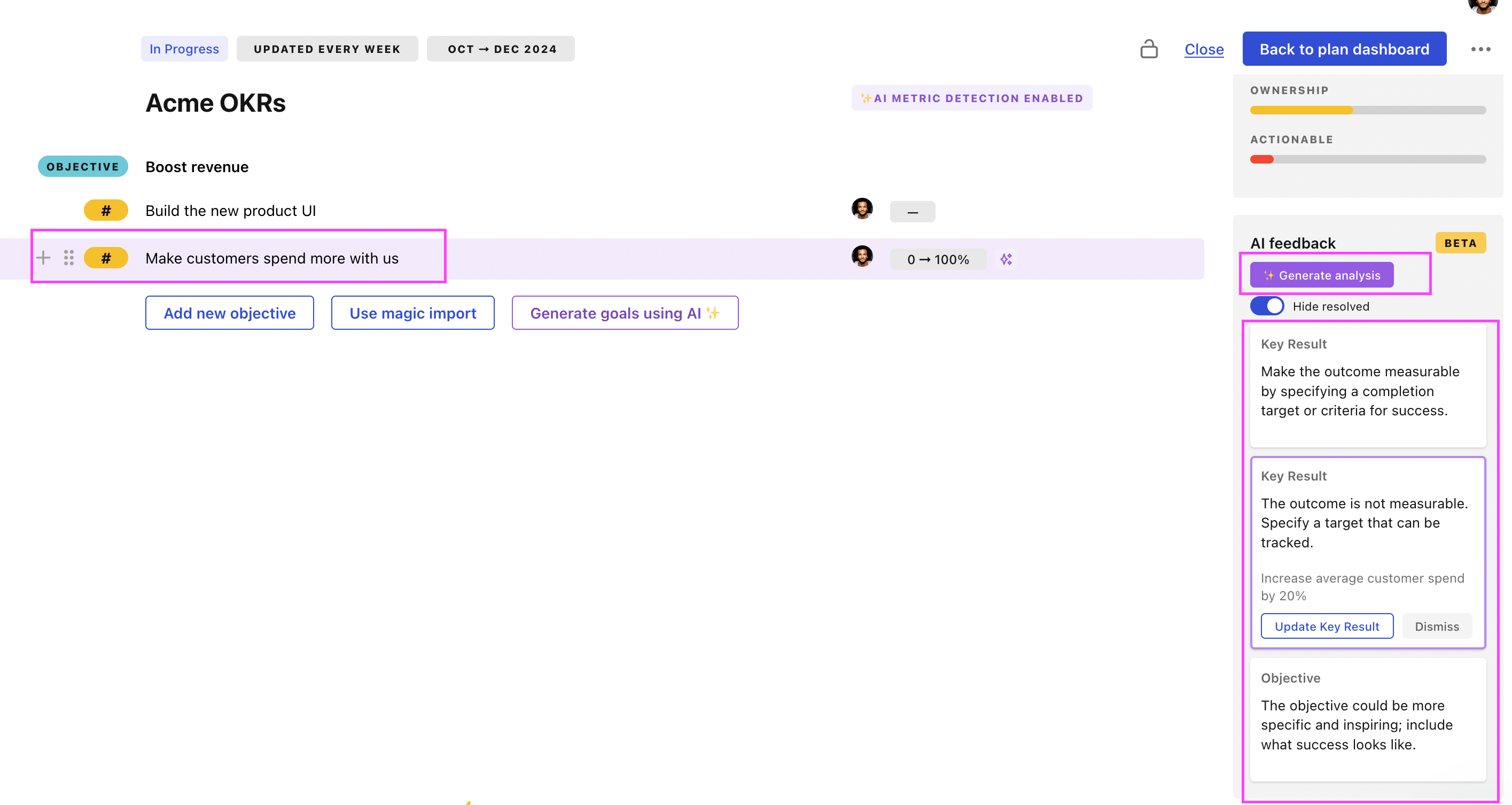

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Regulatory Compliance Officer OKRs examples

You'll find below a list of Objectives and Key Results templates for Regulatory Compliance Officer. We also included strategic projects for each template to make it easier to understand the difference between key results and projects.

Hope you'll find this helpful!

OKRs to enhance the quality and regulatory compliance of debt collection practices

ObjectiveEnhance the quality and regulatory compliance of debt collection practices

KRComplete 100% of mandatory compliance trainings for all team members

Monitor and track team members' training progress

Set deadlines for completing each training course

Identify all mandatory compliance trainings for each team member

KRImplement a 15% improvement in quality assurance scores from customer feedback

Analyze customer feedback and identify areas needing improvement

Train staff on identified areas to rectify issues

Implement customer-directed quality assurance initiatives

KRReduce non-compliance issues by 20% through periodic audits and refinements

Establish process for identifying and correcting non-compliance

Implement follow-up reviews to confirm resolutions

Develop a schedule for regular compliance audits

OKRs to achieve full adherence to all regulatory compliance standards

ObjectiveAchieve full adherence to all regulatory compliance standards

KRCorrect or address at least 95% of identified non-compliant elements

Implement compliant alternatives or fixes for identified issues

Prioritize non-compliance issues based on severity

Identify all non-compliant elements within the system

KRPass an external audit with a minimum score of 90% compliance

Conduct internal audits to ensure compliance

Implement necessary changes to meet compliance standards

Review and understand all compliance guidelines thoroughly

KRImplement a comprehensive training program for all employees on regulatory compliance

Schedule and implement mandatory training sessions for all employees

Determine necessary regulatory compliance topics for training

Source or create compliance training materials and resources

OKRs to achieve complete regulatory compliance

ObjectiveAchieve complete regulatory compliance

KRTrain all staff on new, compliant procedures and confirm verification within Week 12

Confirm verification and understanding of each staff post-training

Ensure all staff completes the provided training within Week 12

Arrange necessary training sessions on new compliant procedures

KRImplement 100% of the needed changes identified in the review by Week 10

Schedule and execute all changes by Week 10

Review the assessment and identify all necessary changes

Prioritize the changes based on impact and feasibility

KRConduct thorough review of current practices against relevant regulations by Week 6

Identify all current practices requiring review

Plan a comprehensive review process by Week 6

Gather all relevant regulations for comparison

OKRs to achieve regulatory compliance and manage change within budget

ObjectiveAchieve regulatory compliance and manage change within budget

KRIdentify and address 100% of current non-compliance issues

Develop plan to correct identified non-compliance issues

Review all current procedures and regulations for compliance discrepancies

Implement revised procedures and monitor adherence

KRImplement necessary changes within 10% under projected cost

Implement project management techniques to streamline operations and reduce costs

Negotiate with vendors for cost reductions or alternative budget-friendly options

Review current budget and identify areas for potential cost savings

KRComplete change implementation, ensuring 0% non-adherence to key regulations

Conduct periodic internal audits for assurance

Develop comprehensive tracking system for regulatory compliance

Educate all staff on updated rules and regulations

OKRs to ensure compliance and adaptability of Finance department for long-term success

ObjectiveEnsure compliance and adaptability of Finance department for long-term success

KRIdentify and prioritize areas for automation and digitization within the Finance department

KRImplement updated financial policies and procedures to meet regulatory requirements

Revise and update financial policies and procedures to align with regulatory standards

Conduct a comprehensive review of existing financial policies and procedures

Identify gaps between existing policies and regulatory requirements

Communicate and train employees on the updated financial policies and procedures

KRTrain all Finance department staff on new compliance protocols and best practices

Schedule a training session for all Finance department staff

Conduct role-playing exercises to practice implementing the best practices

Assess the knowledge and understanding of staff through a post-training evaluation

Develop training materials and resources for the new compliance protocols

KRDevelop a roadmap for integrating emerging technologies to future-proof Finance operations

OKRs to establish a fully functional over-the-counter (OTC) trading desk

ObjectiveEstablish a fully functional over-the-counter (OTC) trading desk

KRImplement a seamless, efficient trading workflow by week 12

Implement and test new trading workflow by week 12

Design new workflow strategies emphasizing seamless transitions

Identify key efficiency gaps in the current trading workflow

KRFinalize the setup of legal entity compliant with trading regulations by week 4

Validate all trading agreements by week 4

Obtain all necessary trading licenses and permits

Establish a compliant company structure

KROpen a fully operational bank account for the entity by week 6

Gather required entity documents by week 3

Determine type of bank account needed by week 1

Open and fund the account by week 6

OKRs to enhance efficiency and accuracy in assurance audit process

ObjectiveEnhance efficiency and accuracy in assurance audit process

KRImplement new automation tools boosting audit efficiency by at least 15%

Research and identify potential automation tools for audit processes

Monitor and evaluate the efficiency improvement of these tools

Implement chosen automation tools into current audit system

KRAchieve 100% compliance with all relevant insurance regulatory standards

Implement necessary changes to ensure compliance

Regularly review insurance regulations for updates

Schedule consistent compliance audits for quality control

KRReduce audit process errors by 20% compared to previous measurements

Implement a comprehensive audit training program for all staff

Regularly review and update audit procedures and standards

Utilize automated auditing software to minimize human errors

OKRs to streamline financial application processes through process orchestration

ObjectiveStreamline financial application processes through process orchestration

KRDecrease average process execution time by 20% compared to previous quarter

KRAchieve 100% compliance with regulatory requirements in financial process orchestration

Implement necessary process changes and updates to ensure 100% compliance

Identify gaps in regulatory compliance and develop corrective action plans

Continuously monitor and evaluate the effectiveness of the revised financial process orchestration

Conduct a thorough review of current financial process orchestration practices

KREnsure process orchestration platform uptime of 99.9% for seamless application integration

Conduct regular disaster recovery tests to ensure seamless application integration in case of failures

Regularly update and patch the process orchestration platform for improved stability and performance

Implement a proactive monitoring system to quickly identify and resolve potential issues

Set up a redundant infrastructure for the process orchestration platform

KRIncrease cross-application data integration rate to 95% for financial processes

Conduct a thorough audit to identify barriers to cross-application data integration

Continuously monitor and refine integration processes to ensure high data integration rate

Provide comprehensive training to employees on using integrated data systems effectively

Implement standardized data formats and protocols to streamline data integration processes

OKRs to launch a successful new insurance product

ObjectiveLaunch a successful new insurance product

KRObtain requisite regulatory approvals for the new insurance product

Follow up on approval status regularly till obtained

Identify necessary approvals for the insurance product from regulatory bodies

Submit applications to appropriate regulatory agencies

KRDevelop a detailed insurance product prototype by involving 15 potential customers

Identify 15 potential customers for feedback sessions

Sketch a draft of the insurance product prototype

Organize feedback/improvement sessions with customers

KRAchieve 5,000 sign-ups for the new insurance product post-launch

Partner with relevant industry influencers for promotion

Develop a strategic digital marketing campaign targeting potential sign-ups

Offer special discounts or bonuses for early sign-ups

OKRs to secure FDA approval for our new pharmaceutical product

ObjectiveSecure FDA approval for our new pharmaceutical product

KRResolve all FDA queries or issues regarding the application within six weeks

Research and compile thorough responses to each issue

Submit all responses and corrections to FDA within six weeks

Identify all FDA queries or issues on the application

KRSubmit a complete and compliant application to FDA within the first month

Review FDA guidelines to ensure application compliance

Submit the completed application to the FDA

Gather all necessary documents and data for application

KRSuccessfully pass the FDA's inspection and audit of our production facilities

Ensure all documentation and records are accurate, updated, and easily accessible

Provide thorough training to staff on FDA regulations and requirements

Maintain the facility's cleanliness and safety according to FDA standards

Regulatory Compliance Officer OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

Having too many OKRs is the #1 mistake that teams make when adopting the framework. The problem with tracking too many competing goals is that it will be hard for your team to know what really matters.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Setting good goals can be challenging, but without regular check-ins, your team will struggle to make progress. We recommend that you track your OKRs weekly to get the full benefits from the framework.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

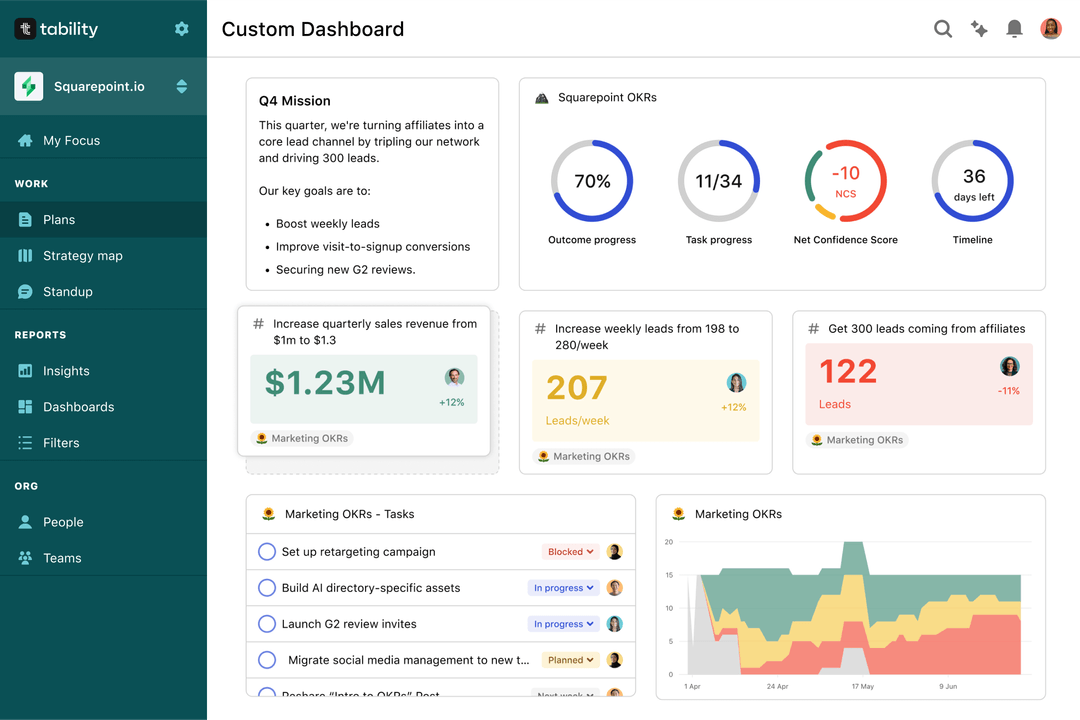

Save hours with automated Regulatory Compliance Officer OKR dashboards

OKRs without regular progress updates are just KPIs. You'll need to update progress on your OKRs every week to get the full benefits from the framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Regulatory Compliance Officer OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to streamline publication of support agent knowledge articles

OKRs to enhance drayage gross margin via cost optimization

OKRs to implement and maintain a comprehensive data protection program

OKRs to decrease user acquisition cost for our mobile app

OKRs to improve students' comprehension of textbook material

OKRs to enhance data analysis capabilities for improved decision making