Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Funding Manager OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Crafting effective OKRs can be challenging, particularly for beginners. Emphasizing outcomes rather than projects should be the core of your planning.

We've tailored a list of OKRs examples for Funding Manager to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Funding Manager OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

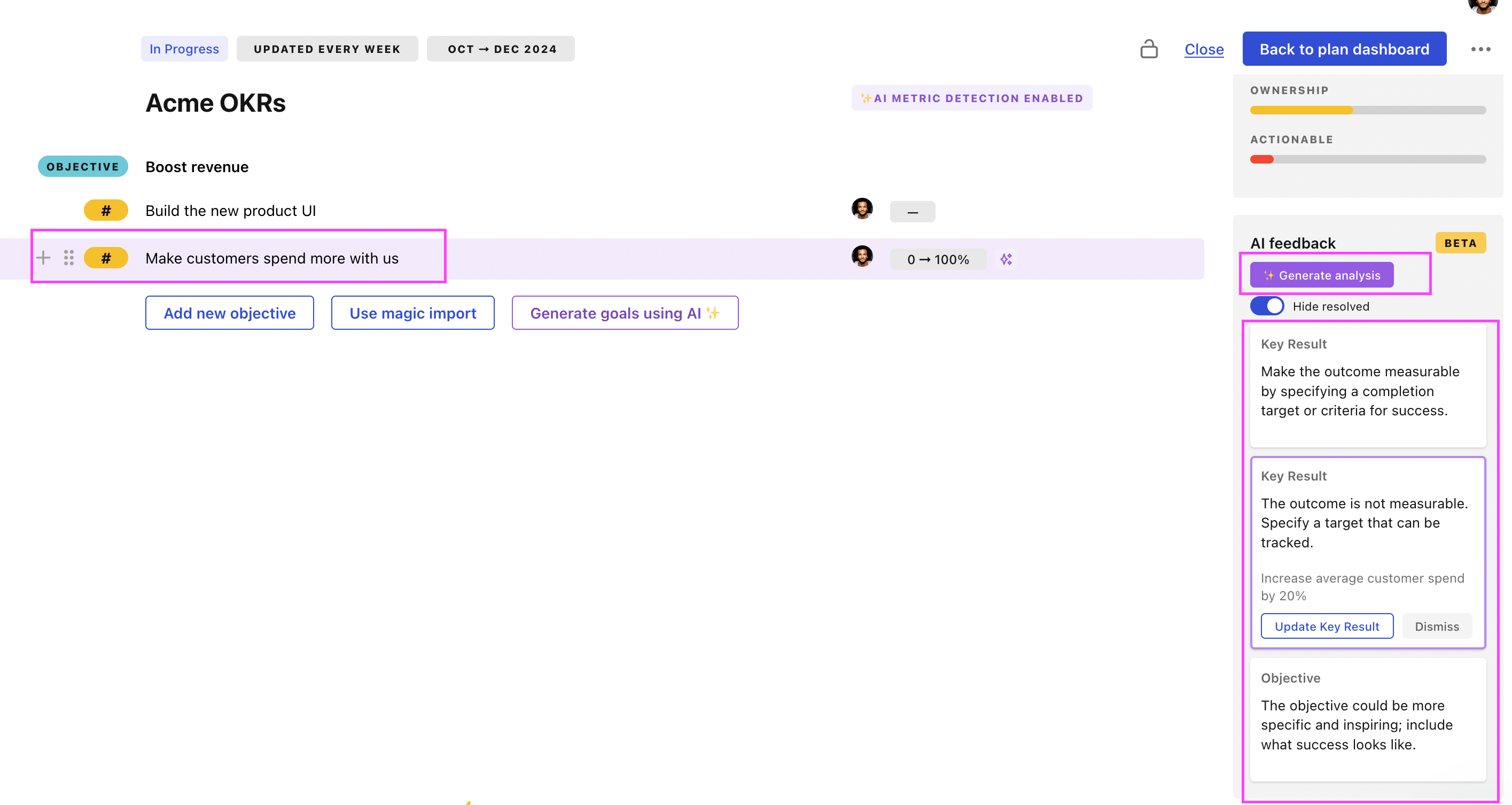

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Funding Manager OKRs examples

You will find in the next section many different Funding Manager Objectives and Key Results. We've included strategic initiatives in our templates to give you a better idea of the different between the key results (how we measure progress), and the initiatives (what we do to achieve the results).

Hope you'll find this helpful!

OKRs to increase unrestricted funding to bolster organization sustainability

ObjectiveIncrease unrestricted funding to bolster organization sustainability

KRRaise 25% more unrestricted funds compared to previous quarter

Identify potential new donors for unrestricted funds

Enhance engagement with current donors

Implement more effective fundraising strategies

KRSecure three new unrestricted funding sources to diversify revenue by Q2

Develop proposals for each target funder

Identify potential new funders in untapped areas

Submit proposals and follow up

KRConduct 5 fundraising events focused on unrestricted funding with 100+ attendees each

Develop and implement a robust marketing strategy to attract attendees

Identify and secure venues which can accommodate 100+ attendees

Determine potential themes for 5 distinctive fundraising events

OKRs to secure $1 million for the pre-seed funding round

ObjectiveSecure $1 million for the pre-seed funding round

KRIdentify and reach out to 50 potential investors by end of phase 1

Initiate contact with each investor through personalized emails

Research and locate contact information for identified investors

Identify 50 potential investors using business directories or networking

KRAchieve commitment for investment from minimum 50% met investors by final phase

Negotiate and finalize investment commitments from participating investors

Create a compelling presentation for potential investors

Schedule and conduct regular meetings with interested investors

KRSecure meetings with at least 25% of identified investors by phase 2

Create a persuasive investment proposal

Schedule and arrange meetings with identified investors

Identify and research potential investors for pitching

OKRs to strengthen collaboration and maximize the impact of public and private partnerships

ObjectiveStrengthen collaboration and maximize the impact of public and private partnerships

KRIncrease the number of public and private partnership agreements by 20%

Initiate targeted outreach and networking efforts to engage potential public and private partners

Develop a compelling proposal highlighting the benefits of collaboration to potential partners

Streamline negotiation and agreement processes to ensure efficient and timely partnership agreements

Research potential public and private partners aligned with our mission and values

KRFoster trust and deepen relationships with partners through regular communication and engagement

Schedule bi-weekly check-ins with partners to share updates and gather feedback

Plan and host quarterly virtual events or webinars to facilitate networking and collaboration

Offer regular performance reviews and acknowledgments to show partners their value and importance

Share relevant industry news and resources with partners to foster knowledge exchange

KRMeasure and enhance the effectiveness of partnerships by conducting quarterly evaluations and feedback sessions

Analyze evaluation data and identify areas for improvement to enhance partnership effectiveness

Implement action plans based on feedback and evaluation results to optimize partnerships

Schedule and conduct quarterly feedback sessions with partners to gather their insights

Develop a comprehensive evaluation framework to measure partnership effectiveness accurately

KRSecure additional funding opportunities by leveraging existing partnerships and identifying new potential collaborators

Review existing partnerships and identify any untapped funding opportunities

Develop a strategic plan to leverage existing partnerships for securing additional funding

Conduct research to identify potential new collaborators with relevant funding resources

Build relationships with potential collaborators through networking events and communication channels

OKRs to raise 1 Million US Dollars as seed funding

ObjectiveRaise 1 Million US Dollars as seed funding

KRIdentify and pitch to 50 potential investors in targeted industries

Create a comprehensive list of 50 potential investors in targeted industries

Research each investor's interests, prioritizing those aligned with our company

Develop and customize pitches tailored to each potential investor

KRSecure commitments from 10 investors at an average of $100,000 each

Schedule individual meetings to present pitch

Identify 20 potential investors for initial outreach

Prepare a persuasive investment pitch

KRExecute fundraising events/campaigns generating $200,000 in total

Organize high-donor events and peer-to-peer fundraising campaigns

Implement donor stewardship plan to encourage repeat contributions

Develop a comprehensive fundraising strategy targeting a $200,000 goal

OKRs to determine sustainable funding requirements for existing programs

ObjectiveDetermine sustainable funding requirements for existing programs

KRPresent findings and implement changes for optimal sustainability by week 12

KRChoose and analyze 3 programs to evaluate their funding sustainability by week 4

Assess the sustainability of their funding by week 4

Select three programs for evaluation

Conduct an analysis of their funding sources

KRDevelop a comprehensive funding structure for each of the selected programs by week 8

Identify budget requirements for selected programs

Research potential funding sources

Draft comprehensive funding plan by week 8

OKRs to secure funding from three new investors

ObjectiveIncrease investor funding

KRSecure funding from at least three new investors

KRCreate a compelling investment pitch

KREstablish new relationships with potential investors

KRSchedule and conduct meetings with interested investors

OKRs to establish funding source for essential staffing positions

ObjectiveEstablish funding source for essential staffing positions

KRIncrease current budget allocation by 10% through cost-saving initiatives or adjustments

Implement selected cost-saving strategies and budget adjustments

Identify potential cost-saving initiatives within the organization

Analyze current budget allocation for possible adjustments

KRIdentify 3 potential funding sources by investigating industry benchmarks and competitors

Research industry benchmarks for potential funding sources

Analyze competitors' funding strategies and sources

Compile a list of three potential funding sources

KRSecure 1 new source of funding confirmed by signed contracts or agreements

Get contract or agreement signed

Identify prospective sources of funding

Initiate contact and negotiate terms

OKRs to achieve optimal resource allocation on funding

ObjectiveAchieve optimal resource allocation on funding

KRReduce operational spending by 10%

Identify inefficient operations and implement cost-saving measures

Negotiate with suppliers for discounted rates

Limit non-essential expenditures

KRImprove ROI on invested funds by 15%

Analyze current portfolio performance and identify underperforming assets

Rebalance portfolio to include identified higher-yield investments

Research potential higher-yield investment opportunities

KRSecure 20% increase in investment funds

Compile financial reports showcasing potential for growth

Develop a persuasive investment proposal

Schedule pitches with potential investors

OKRs to boost funding penetration to stride towards the 10% goal

ObjectiveBoost funding penetration to stride towards the 10% goal

KRIncrease funding proposals by 20% attracting new investors

Develop multi-channel marketing strategy for funding proposals

Strengthen network relationships for increased investor interest

Introduce innovative projects to attract fresh investors

KRImprove approval rate of proposals by 30% with persuasive pitches

Improve team skills by organizing frequent sales pitch training

Conduct research on successful strategies for persuasive pitching

Gather feedback and continuously refine the pitch content and delivery

KRMaintain a 10% increase in total funding secured each month

Regularly communicate updates to current investors

Research and identify potential new investors weekly

Develop and refine the pitch deck continuously

OKRs to broaden funding base for non-profit organization

ObjectiveBroaden funding base for non-profit organization

KRSubmit 15 grant applications to charitable foundations to secure funding

Draft and refine compelling grant applications

Submit applications to targeted foundations

Research foundations offering grants aligned with our cause

KRIncrease monthly online donations by 20% through enhanced social media campaigns

Develop new, engaging social media content to attract donors

Analyze donation patterns to optimize posting times

Promote online giving through targeted social media ads

KRSecure funding from 5 new corporate sponsors by increasing outreach efforts

Research potential corporate sponsors within relevant industry fields

Schedule meetings to present funding pitches

Draft tailored outreach proposals for each target sponsor

Funding Manager OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

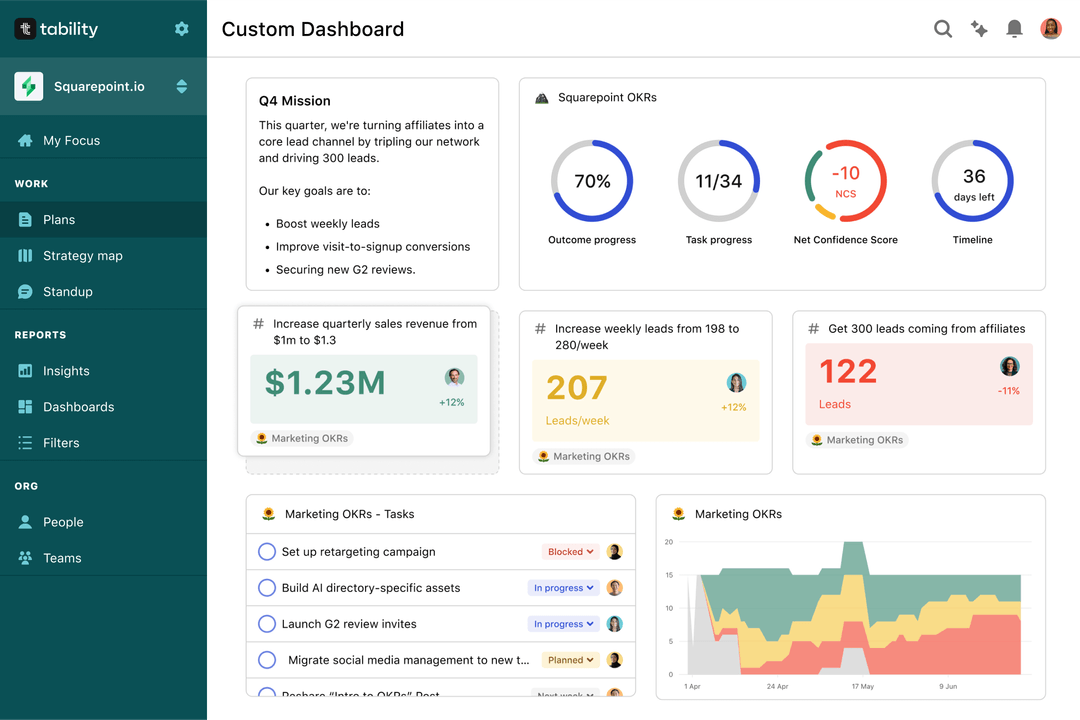

Save hours with automated Funding Manager OKR dashboards

Your quarterly OKRs should be tracked weekly if you want to get all the benefits of the OKRs framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Funding Manager OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to enhance confidence in professional consultancy direction

OKRs to achieve proficiency in Common Core and the Mono Repo

OKRs to ensure all product lines attain organic certification

OKRs to build a superb employee onboarding program

OKRs to boost sales volumes of the specific module

OKRs to acquire pre-requisites for ISO 27001 certification