Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Budget Planner OKRs?

The Objective and Key Results (OKR) framework is a simple goal-setting methodology that was introduced at Intel by Andy Grove in the 70s. It became popular after John Doerr introduced it to Google in the 90s, and it's now used by teams of all sizes to set and track ambitious goals at scale.

Formulating strong OKRs can be a complex endeavor, particularly for first-timers. Prioritizing outcomes over projects is crucial when developing your plans.

We've tailored a list of OKRs examples for Budget Planner to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Budget Planner OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

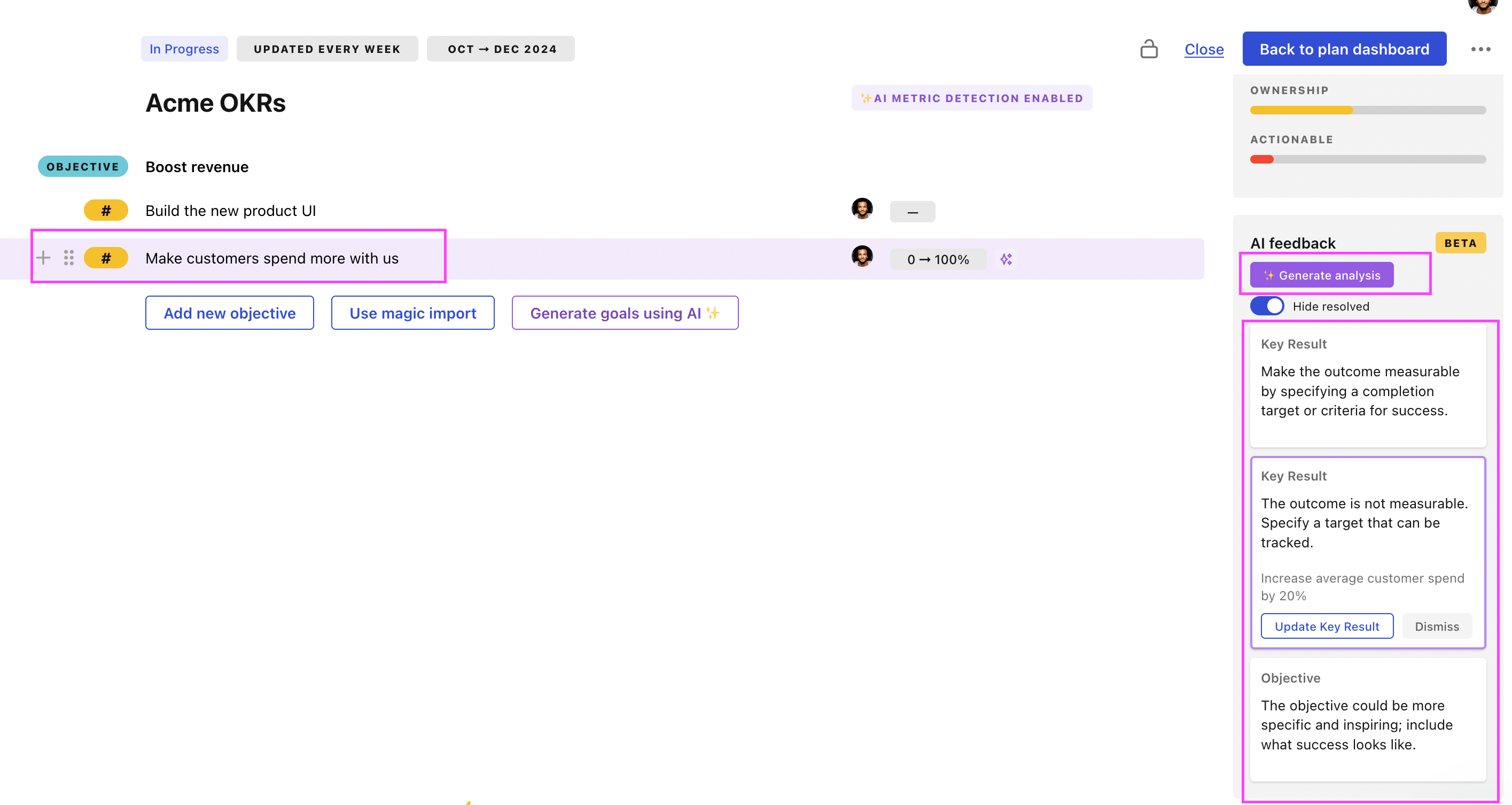

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Budget Planner OKRs examples

We've added many examples of Budget Planner Objectives and Key Results, but we did not stop there. Understanding the difference between OKRs and projects is important, so we also added examples of strategic initiatives that relate to the OKRs.

Hope you'll find this helpful!

OKRs to increase savings towards the 10k annual goal

ObjectiveIncrease savings towards the 10k annual goal

KRSave 1,000 dollars from each month's salary

Set up automatic monthly transfer to savings account

Create and observe a strict budget

Evaluate and cut unnecessary expenses

KRCut unnecessary expenses by 20% to save additional 500 dollars monthly

Cancel unused memberships and subscriptions

Review monthly expenditures and identify nonessential costs

Reduce dining out and grocery spending

KRAdd an extra income stream bringing in 500 dollars a month at minimum

Research and identify viable passive income ideas

Launch a part-time online business or service

Invest in dividend-paying stocks or mutual funds

OKRs to reduce monthly dining out expenditures by half

ObjectiveReduce monthly dining out expenditures by half

KRMonitor and record the cost and frequency of meals eaten out every week

Document each meal eaten out with its cost

Note down the frequency of dining out weekly

Calculate the weekly total of these costs

KRCook at home at least four times a week to reduce restaurant visits

Purchase necessary groceries weekly for meal plan

Create a weekly meal plan with at least four home-cooked meals

Set specific days for cooking at home

KRPlan and follow a strict monthly budget to control spending on meals outside

Analyze previous month's spending on meals outside

Define a reasonable budget for future dining out

Track and limit spending to stay within budget

OKRs to successfully save money to build an investment fund

ObjectiveSuccessfully save money to build an investment fund

KRSet aside 20% of monthly income to a dedicated savings account

Open a separate savings account for monthly deposits

Set up monthly automatic transfers to savings account

Calculate 20% of anticipated monthly income

KRResearch and select 2-3 potential investment opportunities

Conduct thorough research on potential investment opportunities

Define specific criteria for selecting investment opportunities

Choose 2-3 investments that meet your criteria

KRReduce unnecessary expenditure by 15% to increase savings

Identify and eliminate all nonessential expenses

Regularly review and adjust the budget plan

Utilize cash over credit to avoid overspending

OKRs to enhance spendability for improved customer satisfaction

ObjectiveEnhance spendability for improved customer satisfaction

KRImplement 2 new customer-focused promotional campaigns

Execute and monitor the promotional campaigns

Identify potential customer needs and interests for promotional campaigns

Develop strategies and materials for two new campaigns

KRIncrease monthly budget allocation to customers by 20%

Implement the new increased budget into the financial plan

Determine a 20% increase of these individual amounts

Calculate the current budget allocation for each customer

KRImprove customer service training to decrease complaints by 30%

Implement comprehensive customer service training program

Address complaint areas during team coaching sessions

Monitor and assess staff's interaction with customers

Budget Planner OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

Having too many OKRs is the #1 mistake that teams make when adopting the framework. The problem with tracking too many competing goals is that it will be hard for your team to know what really matters.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Setting good goals can be challenging, but without regular check-ins, your team will struggle to make progress. We recommend that you track your OKRs weekly to get the full benefits from the framework.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

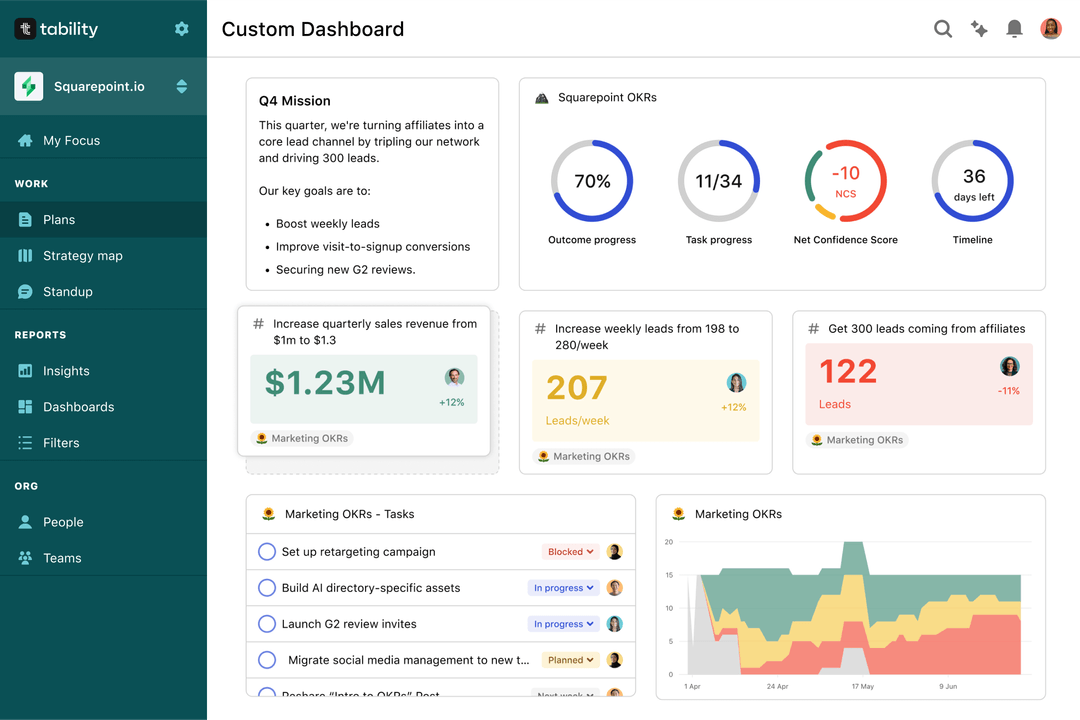

Save hours with automated Budget Planner OKR dashboards

The rules of OKRs are simple. Quarterly OKRs should be tracked weekly, and yearly OKRs should be tracked monthly. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Budget Planner OKR templates

We have more templates to help you draft your team goals and OKRs.