Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Accounts Receivable Manager OKRs?

The Objective and Key Results (OKR) framework is a simple goal-setting methodology that was introduced at Intel by Andy Grove in the 70s. It became popular after John Doerr introduced it to Google in the 90s, and it's now used by teams of all sizes to set and track ambitious goals at scale.

Creating impactful OKRs can be a daunting task, especially for newcomers. Shifting your focus from projects to outcomes is key to successful planning.

We have curated a selection of OKR examples specifically for Accounts Receivable Manager to assist you. Feel free to explore the templates below for inspiration in setting your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Accounts Receivable Manager OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

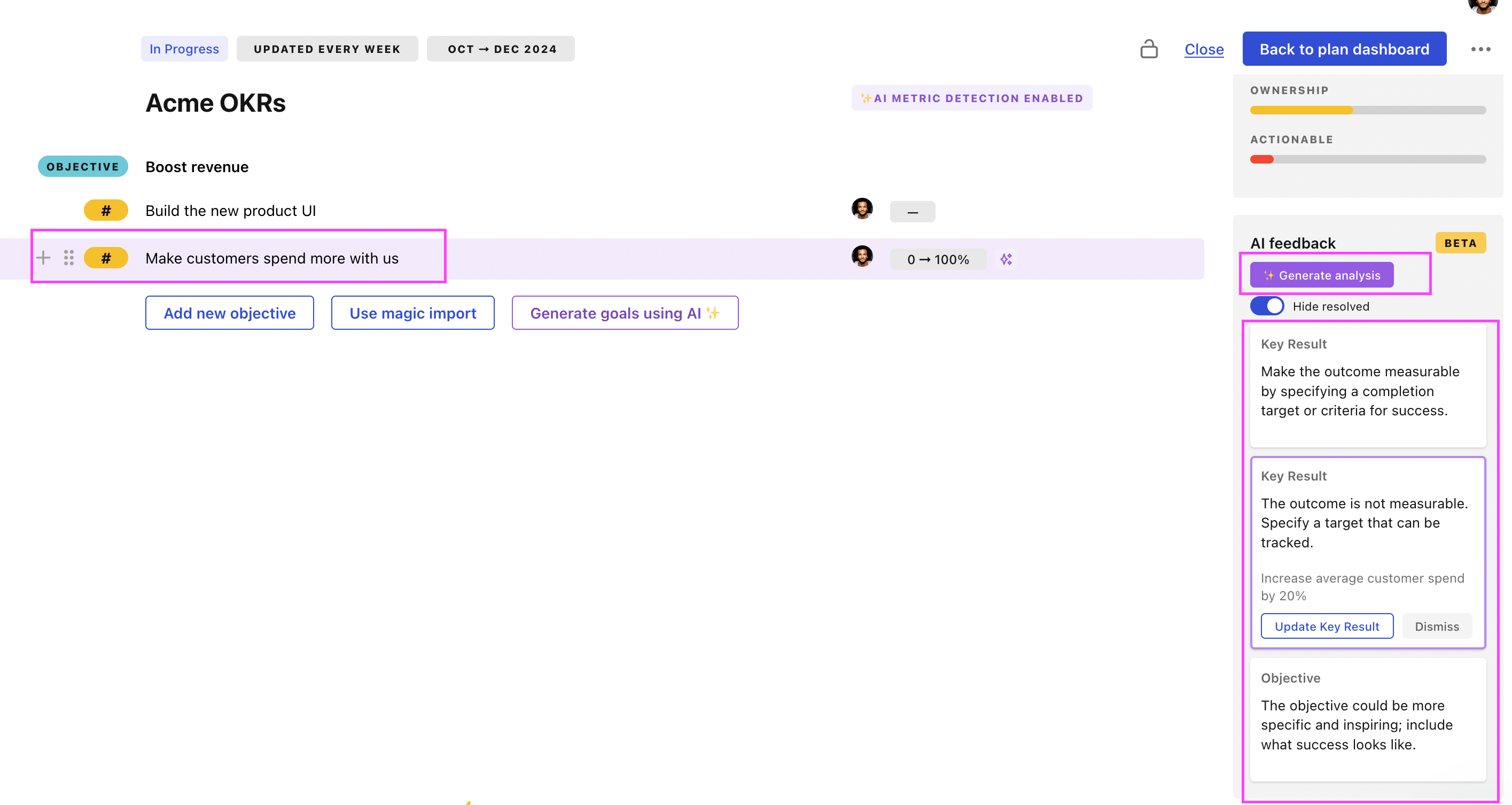

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Accounts Receivable Manager OKRs examples

You will find in the next section many different Accounts Receivable Manager Objectives and Key Results. We've included strategic initiatives in our templates to give you a better idea of the different between the key results (how we measure progress), and the initiatives (what we do to achieve the results).

Hope you'll find this helpful!

OKRs to streamline accounts receivable operations

ObjectiveStreamline accounts receivable operations

KRIncrease collection rates by 25%

Implement an advanced collection management software system

Train staff on effective collection strategies

Incentivize timely payments with discounts

KRReduce invoice processing time by 30%

Streamline invoice approval processes

Train staff on efficient invoice management

Implement automated invoice processing software

KRDecrease outstanding payments by 40%

Implement quicker invoice processing system

Review and update current payment follow-up procedures

Negotiate payment plans with delinquent customers

OKRs to minimize overdue 90-day balances

ObjectiveMinimize overdue 90-day balances

KRImprove the efficiency of the collection process to shorten payment durations by 20%

Implement automated reminders for pending payments

Apply a standardized collection process across all departments

Offer incentives for early payment to clients

KRImplement a 25% increase in debt recovery from the first month of operations

Monitor and adjust strategies as needed

Identify key areas causing low debt recovery rates

Develop and implement enhanced debt recovery strategies

KRDecrease the total number of 90-day balance accounts by 35%

Introduce incentives for early or on-time payments

Implement stricter criteria for granting credit accounts

Analyze account payment patterns to identify consistent delays

OKRs to surpass annual operation plan and meet free cash flow target

ObjectiveSurpass annual operation plan and meet free cash flow target

KRImprove collections process to reduce accounts receivables by 15%

Implement stricter credit control procedures

Escalate overdue accounts faster

Streamline invoice issuance and follow-up systems

KRIncrease sales revenue by 20% to boost free cash flow

Innovate and introduce new revenue-generating services or products

Develop and implement aggressive marketing and sales strategies

Prioritize upselling and cross-selling to current customers

KRCut operational expenses by 10% to ensure positive cash flow

Renegotiate vendor contracts for better pricing

Identify areas of budget waste to mitigate unnecessary spending

Implement cost-saving technology improvements

OKRs to drive premium collection rate to 95% for improved investment income

ObjectiveDrive premium collection rate to 95% for improved investment income

KRAchieve steady growth in monthly investment income by 5%

Increase monthly investment amounts by 5%

Regularly rebalance portfolio based on market trends

Diversify investment portfolio in various growth-oriented sectors

KRReduce outstanding premium payments by 20%

Implement automated payment reminders for customers

Offer incentives for early or regular payments

Develop convenient digital premium payment options

KRIncrease monthly premium collection rates by 15%

Conduct premium audits to identify inaccuracies

Implement an effective reward program for consistent payers

Send reminders before each payment's due date

Accounts Receivable Manager OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

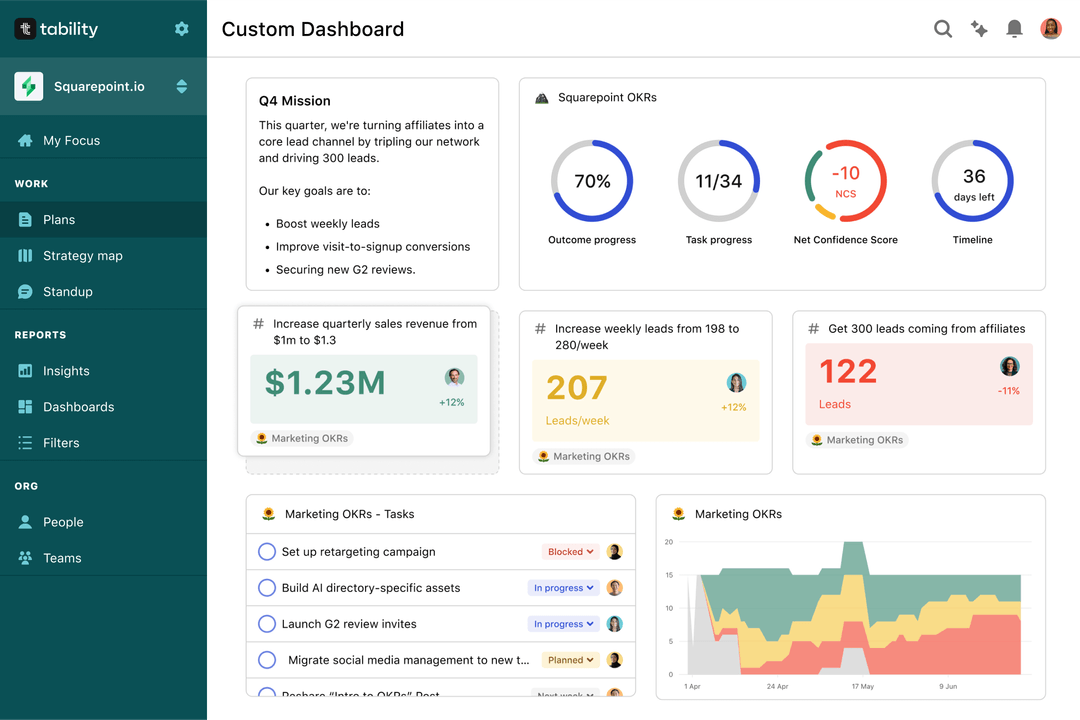

Save hours with automated Accounts Receivable Manager OKR dashboards

Quarterly OKRs should have weekly updates to get all the benefits from the framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Accounts Receivable Manager OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to increase overall property sales performance

OKRs to enhance the career development of our team members

OKRs to streamline financial processes for enhanced profit growth

OKRs to ensure timely submission of financial statement

OKRs to enhance HR capabilities in conducting technical interviews

OKRs to maximize ecommerce revenue through effective email campaigns